Industry Focus: Electronics Industry Trends and What They Mean For Your Water Management Strategy

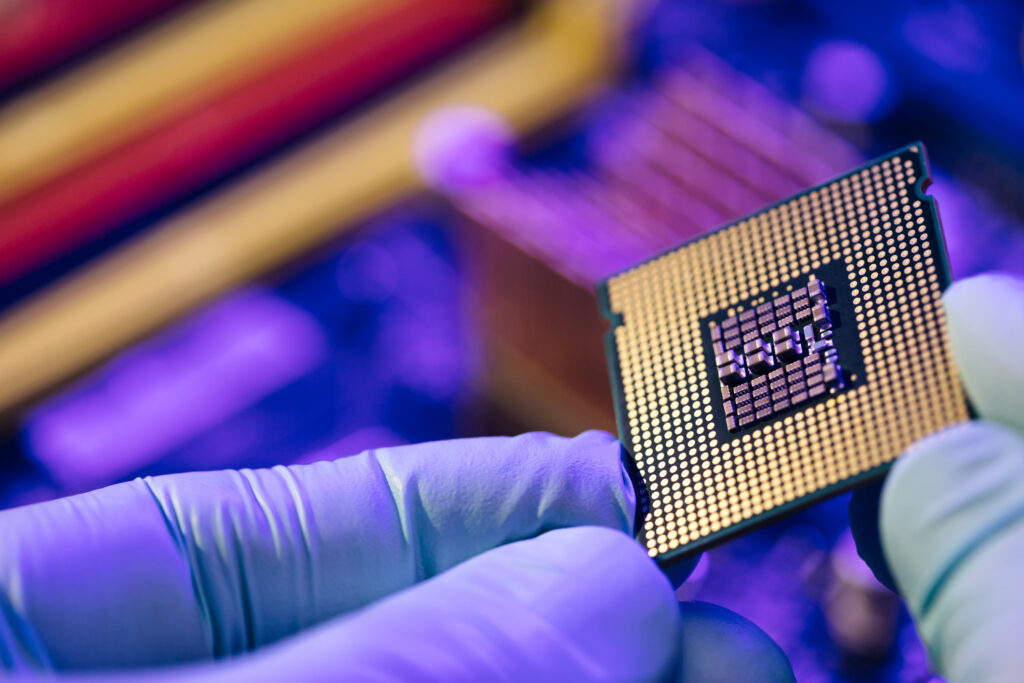

The electronics industry produces all of the devices to support life in an increasingly tech-focused world, including everything from mobile devices and televisions to industrial electronics and telecommunications components. At the core of the electronics industry is the semiconductor sector, which is responsible for producing the chips that are needed for manufacture of devices across other electronics industry sectors. Indeed, semiconductor sales are higher than ever—and that’s despite the semiconductor sector and the broader electronics industry navigating challenges including recent supply chain disruptions and rising environmental concerns.

Here, we’ll look at a few industry trends impacting the electronics industry, specifically with an eye on how these trends may impact water use for electronics and semiconductor manufacturers in the years to come.

Three major trends in the electronics industry

Market trends and growth

Most market analysts expect to see continued growth across the electronics industry over the next several years, with strong demand for electronics products fueled by increased digitization of a broad and growing customer base. In some cases, like in the retail and distributed services spaces, there is some volatility due to rising competition, as well as rapid evolution of the way in which companies interact and do business with consumers through online marketplaces.

The semiconductor sector, regarded as something of a bellwether for the electronics industry as a whole, is expected to show strong growth as demand for electronics products continues to grow. In 2021, global semiconductor sales reached a record of $555.9 billion, with the industry reportedly shipping over a trillion semiconductor units. At this time, the vast majority of semiconductor production is sited in Asia, with Taiwan, China, Japan, and South Korea topping the list of producers. The United States currently accounts for only about 10% of global chip production, although the US has begun to invest in domestic chip production, most notably with passage of CHIPS and Science Act of 2022. This legislation aims to increase US competition in the semiconductor industry, specifically by investing over $50 billion into research, development, manufacturing, and workforce development programs to increase semiconductor chip manufacturing operations. Because of this and other global shifts, semiconductor producers will need to take steps to prepare for increasing competition in coming years.

Lingering supply chain disruptions

While growth is indeed forecasted for the electronics industry as a whole, the story across some sub-sectors has been a bit more complicated. Shortages of semiconductors have had cascading impacts within the electronics industries, and across other industries as well. This is especially true of the automotive industry, which has struggled to keep up with demand due to a well-publicized chip shortage. Effects of the disruptions rooted in the COVID-19 pandemic are still evident in other ways as well, as electronics manufacturers have had to respond to shifting demand for certain types of consumer electronics, like appliances and computers. As lockdowns have eased since the onset of the pandemic, demand has shifted more towards pre-pandemic patterns, but a number of other issues have posed challenges for electronics producers looking to recover and adapt.

As of Q3 2022, supply chain disruptions stemming from the pandemic and resulting economic shutdowns, as well as extreme weather events, and geopolitical tensions, continue to plague semiconductor manufacturers. According to Deloitte, supply chain disruptions are expected to persist at least into 2023. Thus, even as economies have reopened and companies have upped production, supply chain issues have added further challenges to this time of recovery and change.

Sustainability

Sustainability is a growing trend across all industrial sectors, and is especially important in the electronics industry, primarily because it tends to use very water- and energy-intensive processes. As is the case across other industries, electronics producers need to be aware of the risks and pressures of environmental concerns, and have a strategy for mitigating associated risks. Companies are focusing more than ever on environmental stewardship programs, such as implementing programs or systems to cut water or energy use, or to clean up waste streams. Facilities are motivated by a number of factors, such as compliance with stricter environmental regulations, in order to avoid consequences such as hefty fines, or even shutdowns. Other benefits of sustainability programs include satisfying a growing customer demand, as well as helping to keep costs under control should prices for water and energy rise as expected in future years.

Water use in the electronics industry

Companies in the electronics industry use a moderately high amount of water and energy to power their operations. Facilities draw feedwater for things like cooling equipment and HVAC systems, as well as other general purposes like maintenance and landscaping. Semiconductor fabrication plants—or “fabs” as they’re commonly known— are particularly resource-intensive, as they tend to require lots of energy and water. This is because they use a polishing process during manufacturing which results in deposition of a residue on semiconductor chips. To ensure that the chips function as intended, this residue must be removed, and this is accomplished by rinsing the chips with ultrapure water. Fabs must use significant amounts of water and energy to produce ultrapure water, using water treatment processes like filtration, activated carbon, reverse osmosis, degasification, and electrodeionization to remove contaminants and achieve a very high level of purity.

Additionally, electronics facilities produce wastewater streams that typically need some form of treatment before they are released the environment or to a receiving facility. This is because they contain potentially hazardous contaminants including heavy metals, toxic solvents, and can be very acidic.

Water treatment trends in the electronics industry

Due mainly to an increasing emphasis on environmental concerns, and interest in controlling costs associated with sourcing water and disposing of wastewater and brine streams, chip fabs are increasingly adopting water recycling programs to reduce overall water use. In fact, in July 2022, major semiconductor producer Intel announced it achieved net positive water use in the US, Costa Rica, and India, and it has plans to expand the initiative in other countries where it operates.

To achieve these kinds of ambitious goals, those in the electronics industry are increasingly employing water recycling and reclamation initiatives. These types of strategies entail capturing wastewater streams for reuse within the facility. Depending upon the nature of the wastewater, and the target reuse application, treatment needs may range from minimal to moderately involved. Facilities have flexibility in how they choose to implement reuse strategies, such as by combining multiple wastewater streams for treatment and reuse, or by opting to reclaim only the “cleanest” or most suitable streams, such as by reclaiming used rinse water for cooling, for example.

Fabs and other electronics manufacturers are also increasingly opting to implement other types of reduction measures, including by upgrading production equipment and/or water treatment equipment with newer or more efficient technologies. Fabs can also look at their existing processes to identify opportunities for water savings, such as by using counter-current rinses, or reducing the number or duration of rinse cycles without compromising on chip quality. Similarly, cooling towers can be an excellent target for water reduction efforts. Facilities who use evaporative towers can potentially reduce water use by converting to dry or wet/dry towers, for example, by treating feedwater, or by installing means of capturing water vapor for reuse. Electronics manufacturers and industrial facilities more generally are also investing in water use reduction efforts in a number of other interesting ways, such as by using low-flows sinks and toilets. While these types of water reduction approaches entail costs, some of which are significant, they may well pay off in the long run, as these types of investments may help companies to better cope with challenges such as market volatility and rising competition, by insulating themselves against rising costs for water, energy, and waste discharge permits.

How can SAMCO help?

SAMCO has over 40 years’ experience custom-designing and manufacturing water treatment systems designed to conserve water resources, so please feel free to reach out to us with your questions. For more information or to get in touch, contact us here to set up a consultation with an engineer or request a quote. We can walk you through the steps for developing the proper solution and realistic cost for optimizing water use in the electronics or semiconductor industries.

Head on over to our blog to learn more about industrial filtration and process separation technology. Some articles that might be of specific interest to you include:

- https://www.samcotech.com/how-manufacturing-facilities-chemical-industry-can-reduce-water-usage/

- https://www.samcotech.com/what-is-an-industrial-water-treatment-system-process/

- https://www.samcotech.com/what-is-zero-liquid-discharge-and-how-does-it-work/